With the 15th annual Student Housing Investment Conference round the corner, we caught up with the chairperson for the conference, Martin Hadland, to explore the future of student housing.

Martin is the Co-Founder and Managing Director of Student First Group (SFG), a London based specialist advisor, investor, developer and asset manager in the student accommodation and property sectors. Martin and Richard Gabelich founded SFG in 2018 to use their collective, unique and diverse student accommodation and property experience to facilitate transactions and generate innovative solutions. SFG advise on both off-campus/direct let property and on-campus infrastructure partnership models always with the aim of maximising the student experience in both physical design and operating environment.

Martin has over 35 years’ experience working for and advising Universities, property brokers and advisors. He has worked for universities, some of the leading property consultants in the UK and as Commercial Director for a global student accommodation developer/operator..

Here’s what he had to say about the future of student housing.

Where do operators and investors see the market evolving over the coming year?

In the evolving landscape of student housing in the UK, operators and investors are navigating a market marked by contrasting forces of supply and demand, alongside shifting attitudes towards higher education and living away from home. The sector faces a persistent imbalance, with demand outstripping supply in many areas, suggesting that rents are likely to continue rising. However, this trend is juxtaposed with a growing sentiment among UK undergraduates questioning both the value of pursuing university education and the financial viability of studying away from home, which can add significantly to their first-year living expenses.

Amid these dynamics, universities have been required to maintain tuition fees for home undergraduates at a maximum of £9,250 for several years, a policy that initially seemed sustainable but has become increasingly strained as inflation rates have surged. This situation has left universities in a predicament, as they struggle to manage significantly rising costs without corresponding increases in revenue. In response, many have exercised restraint in raising accommodation prices, aiming to alleviate some of the financial pressures on students.

Despite a general consensus that students prefer not to incur higher costs, the market has continually introduced more expensive accommodation options, which have consistently reached full occupancy in most locations. This indicates an historic discrepancy between what students wish to pay and what they are actually willing to pay, with the market gradually moving towards the upper end of this spectrum and uncertainty creeping in as to where we now are. The sector, like others, faces upward cost pressures from construction, land acquisition, and operational expenses, including utilities and labour which means rents are only moving in one direction.

The student housing sector is also affected by changes in the private rental market, particularly the House in Multiple Occupation (HMO) segment, which has seen a decline in private landlords due to regulatory reforms around tax deductibility of debt service costs. The anticipated Renters' Reform Act introduces uncertainties for landlords, including the removal of fixed-term tenancies and allowing tenants to give 2 months notice, which poses specific challenges for student landlords.

Furthermore, rising mortgage rates have led to a decrease in the number of HMOs, with CBRE estimating 400,000 fewer HMO properties available nationally between 2019 and 2023. The extent to which this impacts student housing is unclear, but the trend suggests a significant shift. The HMO market typically houses returning students, and if there is any election by landlords to move out of the sector, then accommodation pressures will continue to increase. Additionally, the Build-to-Rent (BTR) sector has increasingly accommodated students, with many properties housing a substantial percentage of student tenants.

In summary, the UK student housing market is at a crossroads, influenced by various economic, regulatory, and social factors. The sector presents opportunities for growth and innovation but also requires careful consideration of emerging challenges and changing student preferences. Operators and investors must navigate these complexities to meet demand, manage costs, and align with the evolving needs and expectations of their student customers.

With planning challenges, rising build costs, and an increasing cost of borrowing, are there now concerns about the viability of UK Development?

The landscape of UK development, especially in the context of planning challenges, escalating construction costs, and rising borrowing expenses, is becoming increasingly complex. Planning processes are perceived as both more difficult, longer and costlier, a trend that is particularly pronounced in London. Local boroughs are adapting and responding to the London Plan's initial iteration by tailoring policies to meet their specific needs, which has added layers of complexity to planning and development.

The sector has faced significant viability challenges due to the increases in the various costs referred to above. These challenges have led to a noticeable slowdown in the pace of planning applications and approvals since pre-Pandemic times. However, there has been a shift in this trend in the latter half of 2023 and into early 2024, with an uptick in schemes being proposed. This resurgence is partly attributed to the industry adjusting to the regulatory landscape shaped by the Building Safety Act and the certainty that now exists around that. The Act's implications have prompted developers to rethink their projects, especially traditional residential towers in areas like the London Docklands, where new safety requirements such as the need for a second staircase have made some designs unfeasible for mainstream residential use. As a result, there is an emerging trend of these projects being reimagined as mixed-use developments that combine affordable housing, mainstream housing, and student accommodation, which can more easily accommodate the design requirements.

Additionally, demand for development appears to be on the rise, signalling a potentially vibrant period ahead for the sector.

Despite the significant challenges posed by planning difficulties, increased construction and borrowing costs, and the impact of new regulations, there is cautious optimism for the future of UK development. The sector is adapting to these challenges through innovative approaches to project design and a renewed focus on mixed-use developments. This adaptability suggests that concerns about the viability of UK development may be mitigated as the industry moves forward.

How important is ESG and sustainability with each portfolio and how can we repurpose existing stock to meet modern environmental targets?

The importance of Environmental, Social, and Governance (ESG) principles and sustainability within property portfolios has become a central focus in the student housing sector, particularly in how existing buildings can be repurposed to meet contemporary environmental targets. This shift in focus is significantly influenced by the growing awareness of embedded carbon in existing structures, a factor that was less scrutinised in development practices five years ago. Nowadays, there is a concerted effort to retain and repurpose buildings, especially those constructed with materials like concrete that have high levels of embedded carbon, marking a departure from the previous inclination to demolish and rebuild.

Institutions and developers are increasingly adopting and applying methodologies akin to the Passive House standard, which emphasises energy efficiency, to refurbish existing properties. This approach aligns with a broader commitment to the ESG agenda, as demonstrated by initiatives like Unite's extensive refurbishment projects that prioritise ESG considerations. These efforts highlight a recognition of the importance of sustainability in property development and management.

However, the challenge lies in balancing the environmental benefits of repurposing buildings with their operational performance and financial viability. Buildings from the 1970s and 1980s, for instance, may not perform as efficiently as new constructions, even after extensive refurbishments. This discrepancy raises questions about the cost-effectiveness of refurbishing older buildings, the potential rental income from such properties, and their lifespan post-refurbishment.

The ESG agenda is also subject to an "acceleration curve," where standards and expectations are rapidly evolving. The belief that the current pace of improvement will remain static over the next decade is optimistic. Standards are expected to tighten further, placing additional pressure on refurbishment projects to adopt cutting-edge sustainability measures to extend the useful life of assets. This pressure is likely to intensify with the introduction of new legislation or mandates from funders requiring compliance with specific sustainability standards.

Moreover, the government's stance on certain environmental policies, such as the phase-out of fossil fuel boilers by 2030, appears to be softening. This change may impact the urgency and direction of sustainability efforts in the sector.

ESG and sustainability are increasingly pivotal in the student housing sector, driving a shift towards repurposing existing stock to meet modern environmental targets. While this approach presents challenges in balancing performance, cost, and sustainability goals, the evolving landscape of environmental standards and legislation underscores the necessity for forward-thinking strategies in property development and refurbishment.

Students are also driving change through looking at the environmental credentials of the halls they select, although it is too early to assess the extent to which this influences choice of accommodation (is it more important than location and what value is there attached to it in rents) and how does it rank as a selection factor alongside other accommodation facets such as a gym, fast wifi, social/amenity space.

What kind of stock will the UK market demand in coming years in terms of build, design and amenities?

The UK student housing market is poised for diversification in the coming years, reflecting a wide spectrum of preferences in building design, amenities, and overall student living experiences. The current landscape features a vast array of accommodation types, ranging from older stock with shared bathrooms and minimal social spaces to modern developments offering en-suite rooms, studios, and extensive amenity space, some delivering over 1.5 square meters per person. Despite this variety, there is no concrete data pinpointing students' exact preferences and the premium they are willing to pay for specific features.

Location continues to be a paramount factor for many students, often prioritising convenience to campus over luxurious amenities. Nonetheless, the importance of Environmental, Social, and Governance (ESG) considerations is rapidly ascending the list of student priorities. It suggests a growing expectation for sustainability to be integrated into the operational aspects of buildings rather than imposing additional responsibilities on the residents.

The market is experiencing a period of reflection and adjustment, weighing the balance between amenity offerings and the economic implications of such features, including how they affect the overall cost and pricing of accommodations. This introspection is partly driven by development pressures and a re-evaluation of aspects like the optimal size of communal clusters and the efficient use of building areas to hit a satisfactory price point for students.

As the market matures, it's becoming increasingly segmented, indicating that students' choices are becoming more nuanced, with preferences varying widely among specific customer cohorts and individuals. The Property Marketing Strategists have just completed their report on the specific requirements of international students as an example of this. This diversity allows developers and operators to cater to specific segments of the market, offering tailored solutions that align with different budgets and lifestyle choices.

Universities, often advisory clients in the context of student housing, are exploring strategies to optimise their nomination agreements with housing providers to ensure value for money. This involves comparing accommodations with varying levels of amenities to understand how these differences impact rental pricing.

Emerging platforms like Student Crowd, play a critical role in providing students with data to make informed choices about their housing. Such platforms contribute to a better understanding of student preferences and market demands.

The UK student housing market is evolving towards greater diversity and segmentation, driven by a blend of student preferences for location, sustainability, and specific amenities. This evolution is accompanied by a maturing market understanding, enabling students to make more informed choices based on a comprehensive understanding of what they value most in their living arrangements.

Where are the key opportunity areas moving forward, looking both at location and also at the product?

The future of the UK student housing sector reveals key opportunities rooted in partnerships, evolving market demands, and strategic location choices. A significant development is the burgeoning collaboration between universities and the private sector, particularly in the realms of design, build, fund, and operate (DBFO) projects. These joint ventures are becoming increasingly prevalent, driven in part by the influence of the London Plan, which has mandated closer cooperation between educational institutions and developers. This synergy has given rise to what could be humorously termed "university Tinder," a service that matches developers with universities to facilitate mutual support through the planning process, thereby benefiting both parties.

This growing trend towards partnership highlights a shift towards more integrated and mutually beneficial relationships in the development of student accommodations. Additionally, there's an ongoing debate about the demand for building more studio apartments within student housing complexes, a trend balanced against the need for diverse housing options to satisfy different student preferences and budgets, and the impact of building less studios on project viability.

Another pivotal area of opportunity is the exploration of new locations for development, extending beyond traditional urban centres to more cost-effective areas. The increasing consideration of projects in locations previously deemed peripheral (we have been approached about locations in London's zone 6 like Croydon and Dagenham, underscores a broader trend of expanding the geographical scope of student housing investments. This move is partly a response to soaring land costs in central areas, pushing developers to seek feasible alternatives that can still attract student populations. The question around how far students are prepared to travel and still feel that they have the London experience needs constant re-evaluation.

The emphasis on location parallels the maturation of the student housing market, likened to the evolution seen in the hotel industry, where there is always room for new entrants provided they offer something distinct or superior. This dynamic could lead to a redistribution of demand, favouring accommodations closer to educational institutions and potentially impacting the viability of properties in less desirable locations over time.

Furthermore, planning authorities are increasingly playing a mediating role, encouraging developers to consult with universities early in the planning stage. This approach fosters a collaborative environment where educational institutions can have a say in developments affecting their student populations, from influencing design considerations to ensuring developments align with student needs and affordability concerns.

The key opportunity areas for the UK student housing sector moving forward involve deepening partnerships between universities and private developers, exploring new locations for development to navigate economic feasibility, and maintaining a focus on strategic siting relative to educational institutions. These trends indicate a sector poised for innovative growth, emphasising collaboration, strategic location selection, and a responsive approach to evolving market demands and student preferences.

Where are the Joint Venture opportunities in the UK Market?

Joint venture opportunities in the UK student housing market are increasingly centered around sector-specific collaborations rather than specific geographic locations. Our ongoing research, dubbed internally as "the mother of all strategies," draws insights from 20 university accommodation strategies developed over the last 20 months. This comprehensive analysis reveals commonalities across universities, including a mix of accommodation types, with many institutions possessing older halls that feature shared bathrooms or early versions of en-suite arrangements, large cluster sizes, and halls that are often in suboptimal condition. These findings highlight the financial pressures universities face, compounded by significant academic capital commitments that limit their capacity to invest in residential offerings—a crucial component of maintaining competitive edge.

To address these challenges, universities are actively seeking partnerships with the private sector to inject capital and expertise into their accommodation strategies. Three emerging models for such collaborations include:

- Nomination Agreements. These are becoming more prevalent, encouraged partly by the London Plan, which positively requires collaborative relationships among developers, legal teams, and universities. However, the challenge with hard nomination agreements, which obligate the university to fill accommodation spaces, is their impact on the university's balance sheet. As a result, there's a shift towards soft nominations that do not require balance sheet commitments.

- Straight Property Deals. These arrangements bypass public procurement processes if they do not contain service level agreements or other service provisions. This exemption allows universities to consider a different selection mechanism compared to the traditional Design, Build, Fund, Operate (DBFO) projects, which involve comprehensive service agreements.

- Local Authority and Public Sector Landowner Involvement. Ambitious local authorities and public sector landowners are increasingly interested in student accommodation for its stable income and annual inflationary uplifts. This interest is exploring the potential of integrating student housing into their investment portfolios, especially for landowners assessing parcels for suitability for student accommodation developments.

The involvement of local authorities and public sector landowners in inner-city developments signifies a broader trend of joint ventures extending beyond the private sector, incorporating public and semi-public entities into the development process. These collaborations offer a promising avenue for addressing the accommodation needs of universities while contributing to the local economy and urban development.

The future of joint venture opportunities in the UK student housing market lies in innovative partnership models that transcend traditional boundaries. By leveraging the strengths of both the private and public sectors, these collaborations aim to enhance the quality, affordability, and sustainability of student accommodation across the UK, responding to the evolving needs of universities and their students.

Any final thoughts?

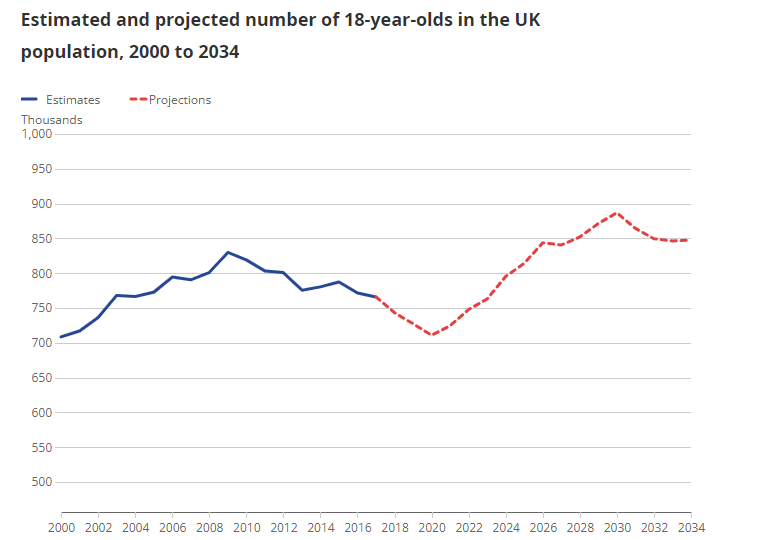

In these dynamic times, there are ample reasons for optimism within the UK's student housing sector. Forecasts suggest a favourable economic environment ahead, with expectations of declining interest rates and inflation. This backdrop is further bolstered by demographic trends, notably a projected increase in the number of 18-year-olds reaching a peak in 2030, which anticipates an additional influx of approximately 100,000 18 year olds in the next five to six years. While international student recruitment has slightly dipped, it remains robust, adding to the sector's growth potential. These predictions are broad brush national figures and need analysis for regional nuances. Also, student number projections are based on assumptions around immigration policy and participation rate in Higher Education which might change with Degree Apprenticeships and the ongoing debate about the value of an undergraduate degree in certain subjects.

Source: ONS

However, challenges persist, particularly in accommodating the growing student population. Issues of housing availability, especially for second and third-year students, have become pronounced, as evidenced by the housing pressures in cities like Durham. This situation raises critical questions about the roles of universities and the private sector in providing sufficient, affordable accommodation for returning students amidst uncertainties in international student numbers and the burgeoning domestic undergraduate population.

Looking ahead, the sector may experience stability in rental prices, contingent on inflation control. This stability presents an opportunity for developers to introduce more sustainable housing solutions. Yet, hurdles remain, including planning complexities, variable policy landscapes across regions, and the economic viability of refurbishing or repurposing existing student accommodations. The investment market shows a preference for high-quality new builds over older, repurposed properties, reflecting differing levels of risk and expected returns.

An interesting facet of the future landscape is the potential for cross-sector integration within the housing market. Historical models, such as 50-year concession deals, highlight the evolving nature of student housing as part of a broader living ecosystem, which might benefit from more flexible and inclusive planning approaches. For instance, experiences from places like Vienna, where housing developments serve multiple demographics and purposes, suggest that the UK could explore more open planning models. These could include intergenerational living arrangements, blending student housing with other residential formats to enrich community life and enhance mutual understanding among diverse groups.

In summary, the UK student housing sector stands at a crossroads of opportunity and challenge. The path forward involves navigating demographic trends, economic conditions, and planning complexities, all while embracing innovative housing solutions that cater to a diverse student population. The sector's capacity to adapt and evolve in response to these factors will be crucial in shaping its future trajectory, making it an exciting and dynamic field to watch.

To learn more about student housing, book your ticket to our conference here.