Just over three months after newsrooms around the country announced that we will be leaving the European Union, the UK housing market has settled down reasonably well. Initial figures indicated that around a third of commercial deals were suspended and prime developments suffered the biggest hits, but mainstream residential markets lay in wait for a price plummet that hasn’t come to fruition. As residential property sales have sustained, the next port of call for calmed investors is which property markets have made it to the UK hotspots list after Brexit. Here’s a run-down of promising markets and current hotspots to consider.

National up-and-comers

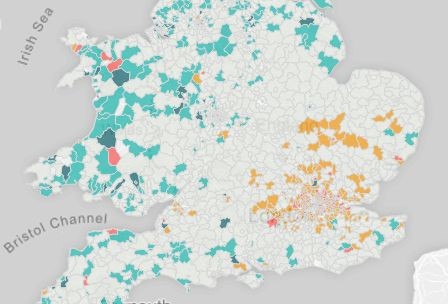

Back in March, Which? published its report on the UK’s up-and-coming hotspots, based on Land Registry data between August 2015 and July 2016. Its interactive map revealed a peppered landscape, with low-cost areas like Basingstoke and Dean, Carmarthen, and Conway outstripping popular residential areas like Oxfordshire and Cambridgeshire. Standout performers that are ripe for investment, based on price increase figures alone include:

- Copeland: +47.7%

- North Devon: +47.2%

- Carmarthenshire: +40.7%

- Conwy: 34.5%

- Basingstoke and Dean: 31.9%

The national view revealed that Northern and Welsh hotspots, in particular, are becoming isolated pockets that do not follow the usual price dispersions that characterise regional housing prices. Regeneration strategies and transport link improvements have been pledged in areas like Copeland and Carmarthen, which are both standard indicators of growth potential in the local property market.

Source: Which?

London growth pockets

Land Registry data from 2015 gives credence to the argument that the UK capital follows its own rules, with a cluster of mid to high performance markets, from Bromley and Croydon in the south to Barnet and Epping Forest in the north. Financially-exhausted areas like Westminster and Kensington and Chelsea failed to keep up with the pace earlier in the year, with sluggish growth as low as 1.8%. With prices in the latter property area up to 50 times the average household salary in the borough, the scope for investors and developers to create future housing stock is dwindling.

Regeneration and transport links aren’t the only measures of regional success. Demographic and targeting specialist, CACI, recently collaborated with Property Week to produce a desirable location list based on value for money and quality of life: important metrics for any developer. Its top five London hotspots, based on these measures, are as follows:

- Bromley (+2) – CACI score of 61.1% (23-29.6% growth rate)

- 2. Barnet (+1) – CACI score of 60.7% (25.9% growth rate)

- 3. Richmond upon Thames (+13) – CACI score of 60.2%, (21.4% growth rate)

- 4. Wandsworth (-) – CACI score of 59.7% (15.2% growth rate)

- 5. Kingston upon Thames (n/a) – CACI score of 57% (25.3% growth rate).

If we compare this hotspot list to how property prices have fared since August 2015, we can see that these areas are amongst London’s mid-growth performers, away from the highest growth areas in the capital, such as Haringey (+34.8%) and Waltham Forest (+41.7). Rather than draw up a range of conclusions as to why this should be the case, these market insights should indicate that growth potential and quality of life measures have aligned for London developers.

London buy-to-let investment

Private Rental Sector (PRS) hotspots in London are slightly easier to assess. The sector has not only remained buoyant before and after the vote, it is also predicted to become an even more dominant form of tenure - approximately 60% of Londoners will be renting in the city by 2025. London rents today average £1,510 a month, and rates largely mirror wage growth. Rents in Greater London are now rising a two-year low, but high yields are still available in pockets of the capital.

Those looking to sell a buy-to-let property should chase high capital gains in West London, while those on the hunt for high yields should head to the south and east.

High-yield markets mirror recent wealth shifts in the London residential markets to the outer fringes. Newham, which featured heavily in our London growth markets guide last year, has an average rental yield of 4.5%, largely thanks to heavy regeneration during London’s 2012 Olympics year. East Ham (within Newham) also presents ROI opportunities for investors, while over to the east in Dagenham and Romford, rental yields can easily top 5.5%.

Residential insights shared by industry leaders

As the Telegraph rightly points out, ‘A rational, not emotional, investor can be a canny winner after Brexit’. LD Events provides an industry platform for thousands of senior property professionals and investors to share high-level market information, analysis and networking opportunities.

The 2016 National Residential Investment Conference has been completely updated to reflect the current market, with presentations from some of the most respected figures in the sector. Hear about some new innovations and opportunities, understand how developers and investors can structure deals, look at joint ventures with public land, and learn about the future of the Resi Investment Market across the UK.

This event is likely to sell out again so please book early to guarantee your place.